A university scholar, Dr. Ochuko Emudainohwo, has described Nigeria’s 2025 tax law as a forward-looking fiscal framework capable of driving inclusive economic growth and repositioning the country for a more diversified and resilient economic future.

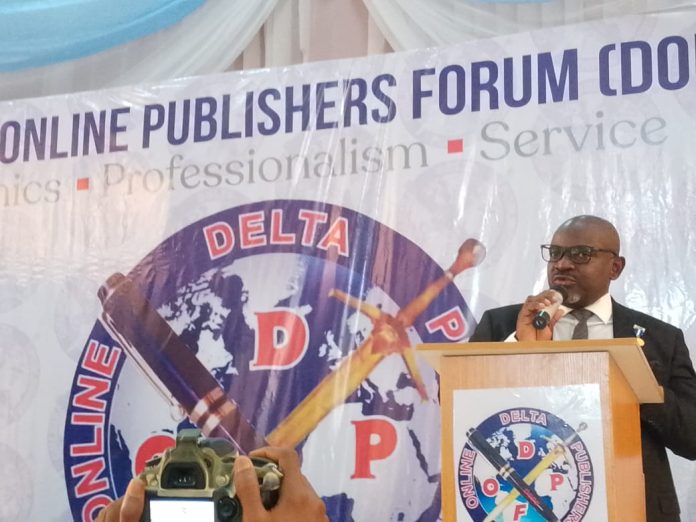

Speaking as Guest Lecturer at the Delta Online Publishers Forum (DOPF) 2025 Lecture Series in Asaba, Dr. Emudainohwo, FCA, an Associate Professor of Accounting at Dennis Osadebay University, Asaba, urged businesses, policymakers, and citizens to embrace the reform and contribute to a more transparent and sustainable fiscal environment.

Delivering a lecture titled “Nigeria’s New Tax Law: Implications and Opportunities for Businesses and Society,” he explained the rationale, structure, and potential impact of the new legislation introduced under President Bola Ahmed Tinubu’s administration.

According to him, taxation remains a vital tool for national development, and understanding the new law requires appreciating the context in which it emerged.

He identified several challenges that made reform unavoidable: declining oil revenue, increasing pressure on public services due to a growing population, and lingering economic shocks from the COVID-19 pandemic, which exposed vulnerabilities in Nigeria’s revenue system.

“These realities compelled the federal government to rethink its fiscal strategy and adopt a more sustainable and inclusive approach,” he noted.

Dr. Emudainohwo emphasized that a key goal of the 2025 tax law is to reduce Nigeria’s long-standing dependence on oil.

The reform consolidates income and company taxes into a unified tax structure, simplifying compliance and easing administrative processes.

He described the law as “pro-people,” highlighting its potential to stimulate growth across multiple sectors.

“The law supports Small and Medium Enterprises. Companies with an annual turnover of less than N50 million are now exempt from capital-based taxes and company income tax,” he said.

He explained that this provision is expected to lessen the financial burden on small businesses, foster entrepreneurship, and encourage innovation.

Dr. Emudainohwo further pointed out that the law prioritizes transparency and modernization by enhancing digital tax systems.

Strengthened digital platforms, he said, will improve accountability, reduce inefficiencies, and minimize leakages within the revenue chain