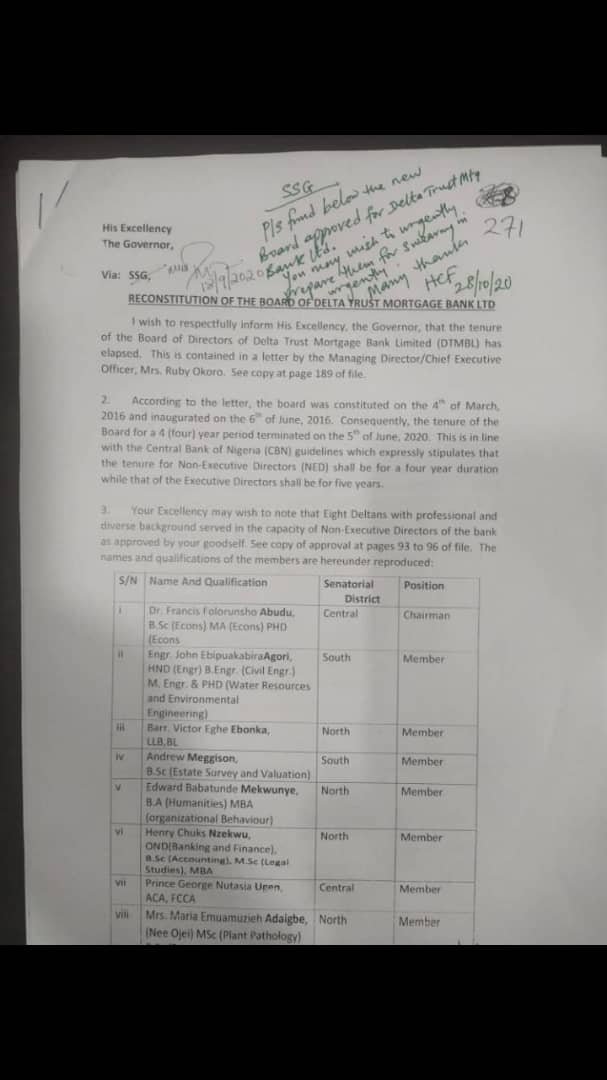

The Story, is currently in possession of a letter, addressed to the state governor, dated 12/10/20, titled: “RECONSTITUTION OF THE BOARD OF DELTA TRUST MORTGAGE BANK LTD”, sent by the State Commissioner for Finance, Sir. Fidelis Tilije, wherein the governor was informed of the elapsed tenure of the Board of Directors of the Bank through a letter allegedly by Mrs. Ruby Okoro, the Managing Director/Chief Executive Officer of the Bank.

The Story source, alleged that the MD/CEO, hoodwinked the Finance Commissioner into playing her script by writing the letter to the governor to find an avenue of giving “the dog a bad name” in order to hang it as they (Management Staff) acts as a watchdog by ensuring that she is guided on the right path.

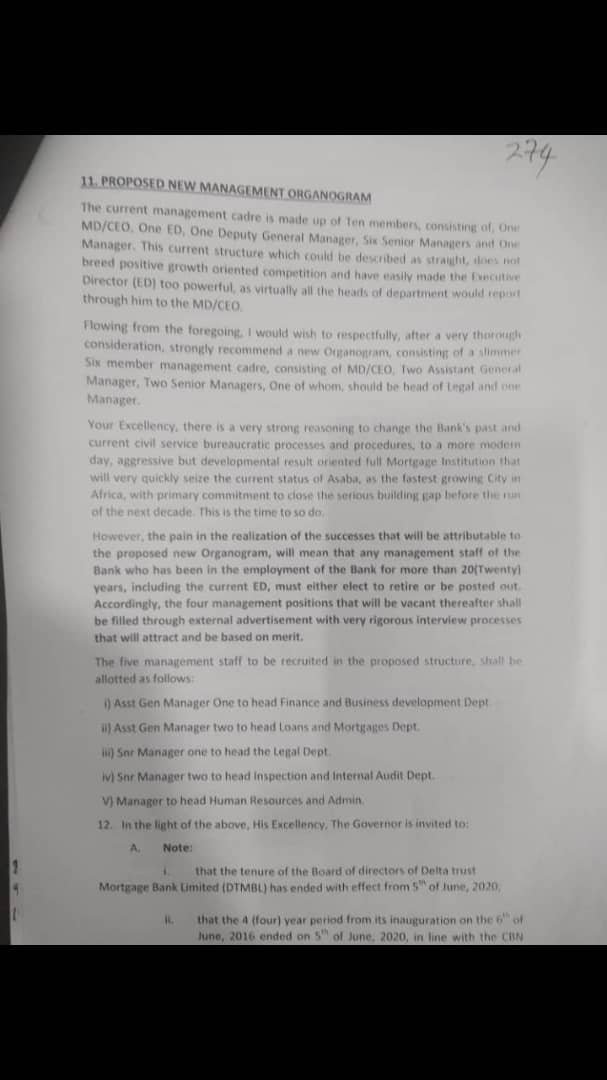

According to the letter, the proposed new management organogram (the current management cadre) is made up of 10 members, consisting of one MD/CEO, one Executive Director, one Deputy General Manager, six senior Managers and one Manager.

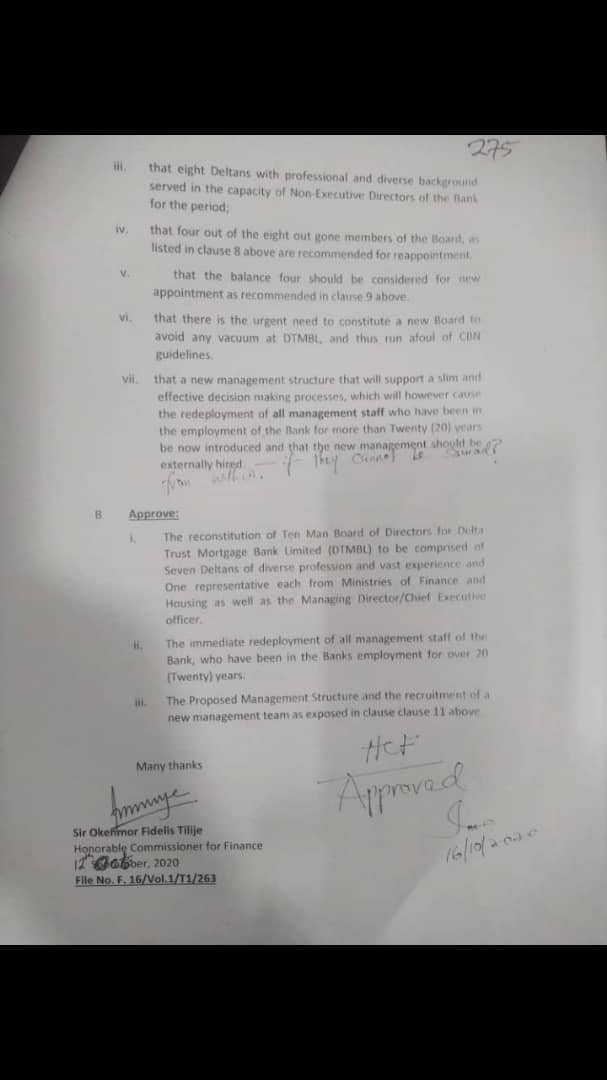

However, in what looked like a clandestine move, the Commissioner recommended a new organogram consisting of slimmer six management cadre consisting of MD/CEO, two Assistant General Manager, two senior Managers, one of whom should be head legal and one Manager.

Hear him: ” Your Excellency, there is a very strong reasoning to change the bank’s past and current Civil Service bureaucratic process and procedures, to a more modern day, aggressive but developmental result oriented full Mortgage Institution that will very quickly size the current status of Asaba, as the fastest growing City in Africa with primary commitment to close the serious building gap before the next decade. This is the time to so do”.

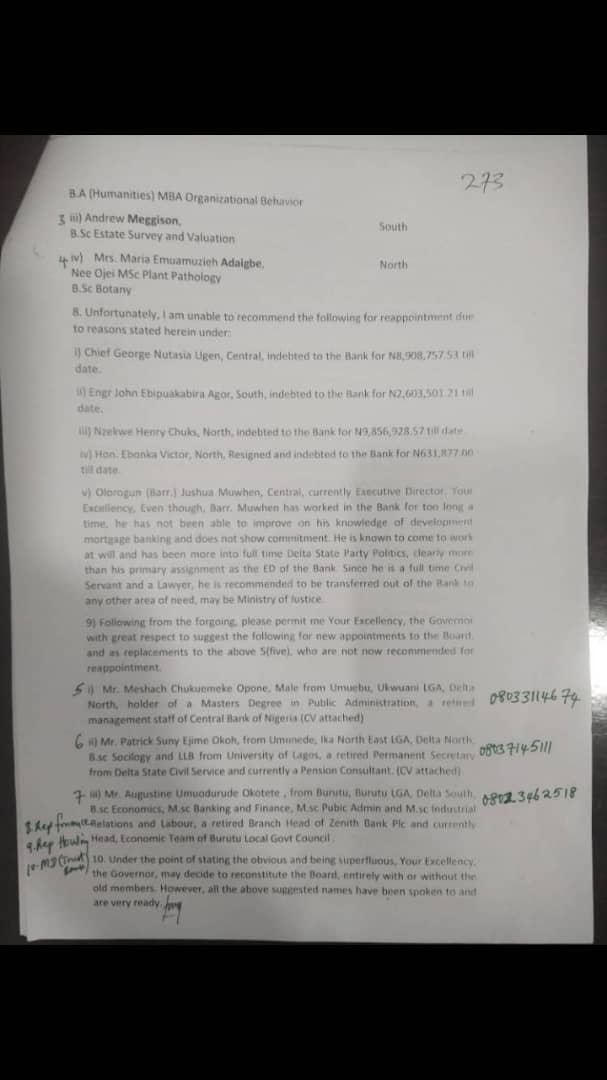

He noted that the pain in the realization of the successes that would be attributable to the proposed new organogram, would mean that “any management staff of the Bank who has been in the employment of the bank for more than 20 years including the ED, must either elect to retire or be posted out.

“Accordingly, the four management positions that will be vacant thereafter shall be filled through external advertisement with very rigorous interview process that will attract and be based on merit”, reiterating that the five management staff to be recruited in the proposed structure shall be Assistant General Manager One to head finance and business development department, Assistant General Manager Two to head loans and Mortgage Department, Senior Manager one to head legal department, Senior Manager two to head Inspection and Internal Audit Department and Manager to head Human Resources and administrative.

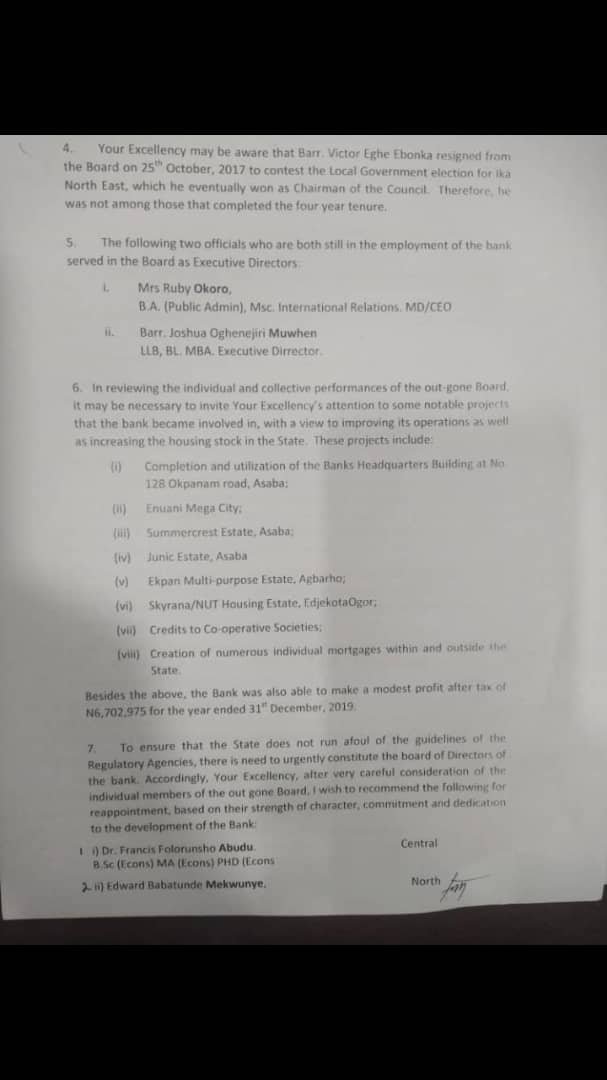

Tilije, called on the governor to note that the tenure of the Board of Directors of Delta Trust Mortgage Bank Limited has ended with effect from 5th of June 2020, “that eight Deltans with professional and diverse background served in the capacity of Non-Executive Directors of the Bank for the period

“That four out of the eight out gone members of the Board as listed in clause 8 above are recommended for reappointment. That the balance four should be reconsidered for new appointment as recommended in clause two above”, calling for an urgent need to constitute a new Board to avoid vacuum at the Delta Trust Mortgage Bank Limited.

Sir. Tilije, suggested the appointment of one Mr. Meshach Chukwuemeka Opone, from Umuebu, Ukwuani local government area, Mr. Patrick Sunny Ejime Okoh, from Umunede, Ika north east and Mr. Augustine Umuodurude Okotete, from Burutu local government area of the state as replacement for the five who are not now recommended for reappointment.

It was gathered that the MD/CEO, allegedly imported a female from Abia and some persons from Anambra States and given local government of origin from councils within Delta north to take the place of Deltans and people living in Delta who are supposed to be entitled to work in the Bank.

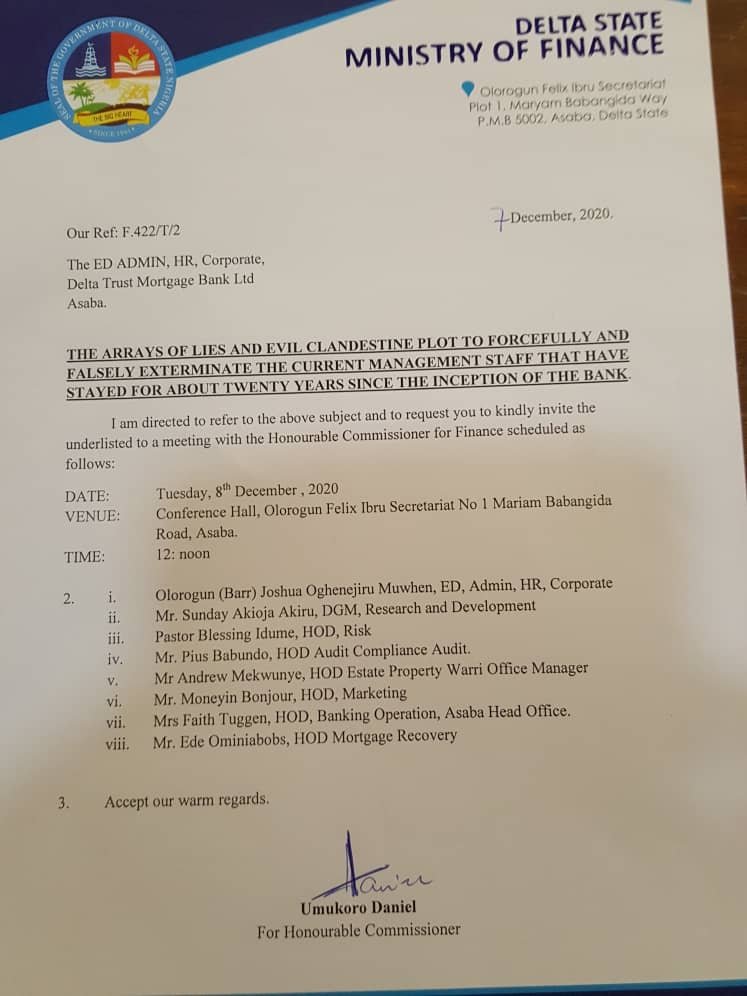

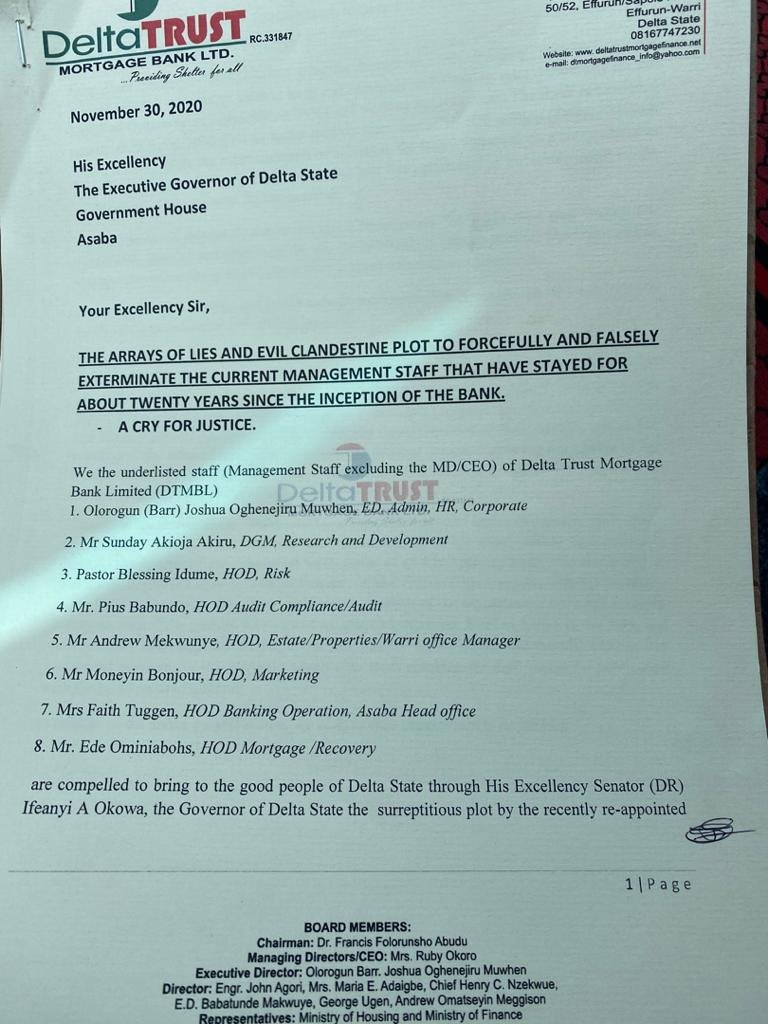

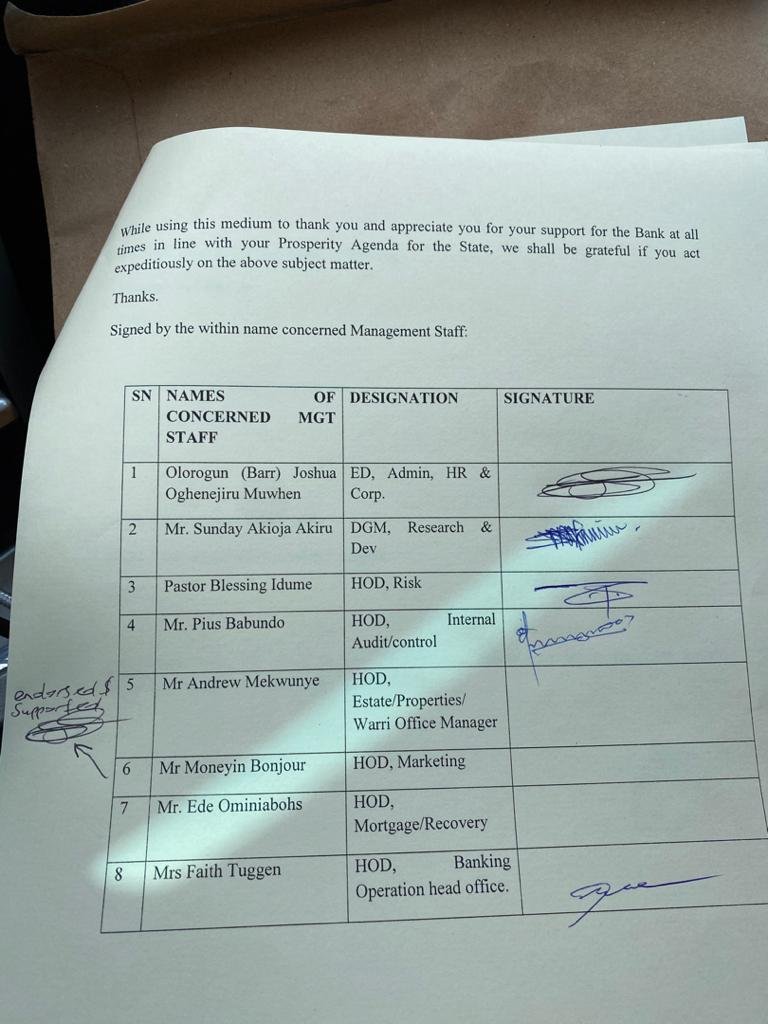

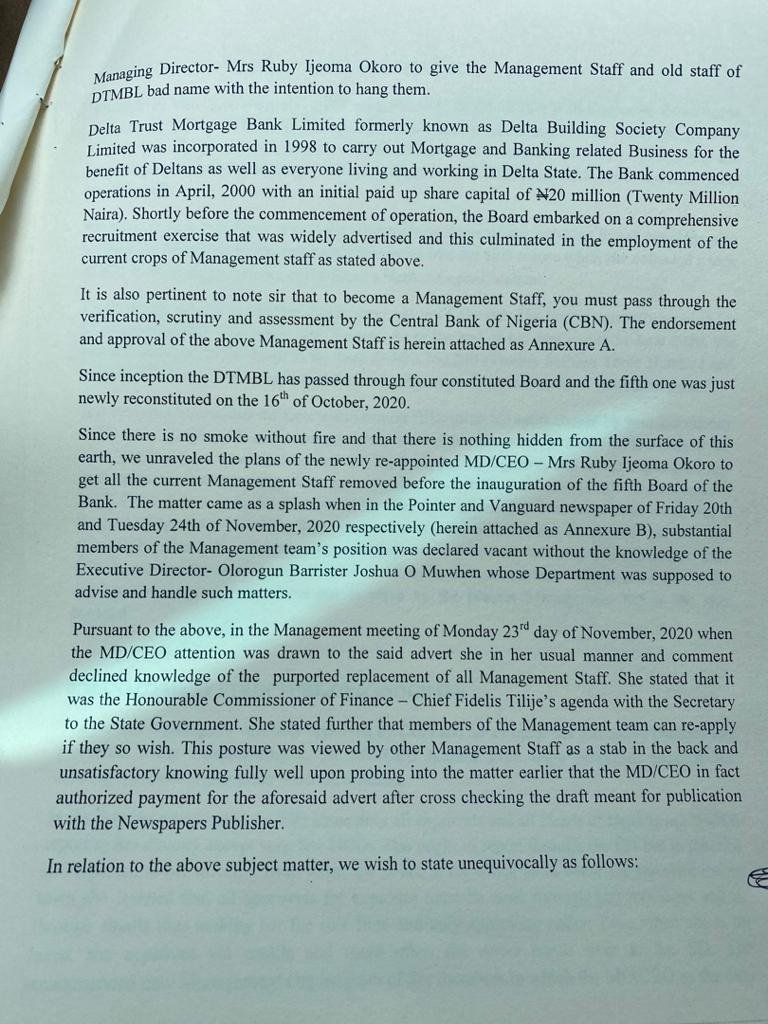

However, in a swift reaction to the letter written to the governor by the Finance Commissioner, the Executive Director of the Bank, Olorogun (Barr) Joshua Oghenejiru Muwhen and seven others in a petition dated November 30th 2020, also addressed to the governor and obtained by The Story, titled: “THE ARRAYS OF LIES AND EVIL CLANDESTINE PLOT TO FORCEFULLY AND FALSELY EXTERMINATE THE CURRENT MANAGEMENT STAFF THAT HAVE STAYED FOR ABOUT TWENTY YEARS SINCE THE INCEPTION OF THE BANK”, A CRY FOR JUSTICE, noted that they were compelled to bring to the good people of Delta State through the governor the surreptitious plot by the recently reappointed Managing Director, Mrs. Ruby Ijeoma Okoro, to give the Management Staff and old staff of the Mortgage Bank bad name with the intention to hang them.

Accordding to the petitioners, “since there is no smoke without fire and that there is nothing hidden from the surface of this earth, we unraveled the plans of the reappointed MD/CEO, Mrs. Ruby Ijeoma Okoro, to get all the current Management Staff removed before the inauguration of the fifth Board of the Bank.

“The matter came as a splash when in the Pointer and Vanguard Newspaper of Friday 20th and Tuesday 24th November, 2020 respectively the substantial numbers of the Management Team’s position was declared vacant without the knowledge of the Executive Director, Olorogun Barrister Joshua Muwhen whose department was supposed to advised and handle such matters”.

According to them when her attention was drawn to the advertisement in the Management meeting of Monday 23rd November 2020, she allegedly declined knowledge of the purported replacement of all the Management Staff.

She was quoted to have said that it is the agenda of the Finance Commissioner with the Secretary to the State Government (SSG), saying that the management team could reapply if they so wish, “This posture was viewed by other management staff as a stab on the back and unsatisfactory knowing fully well upon probing into the matter earlier that the MD/CEO in fact authorized payment for the aforesaid advert after cross checking the draft meant for publication with Newspapers Publisher”.

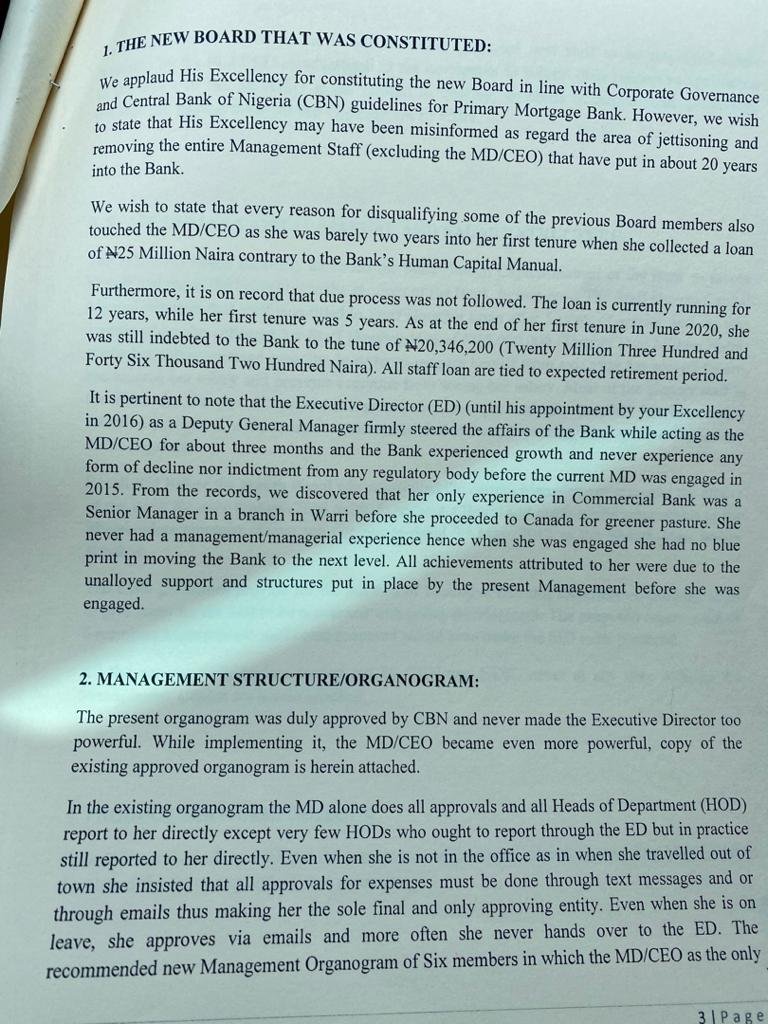

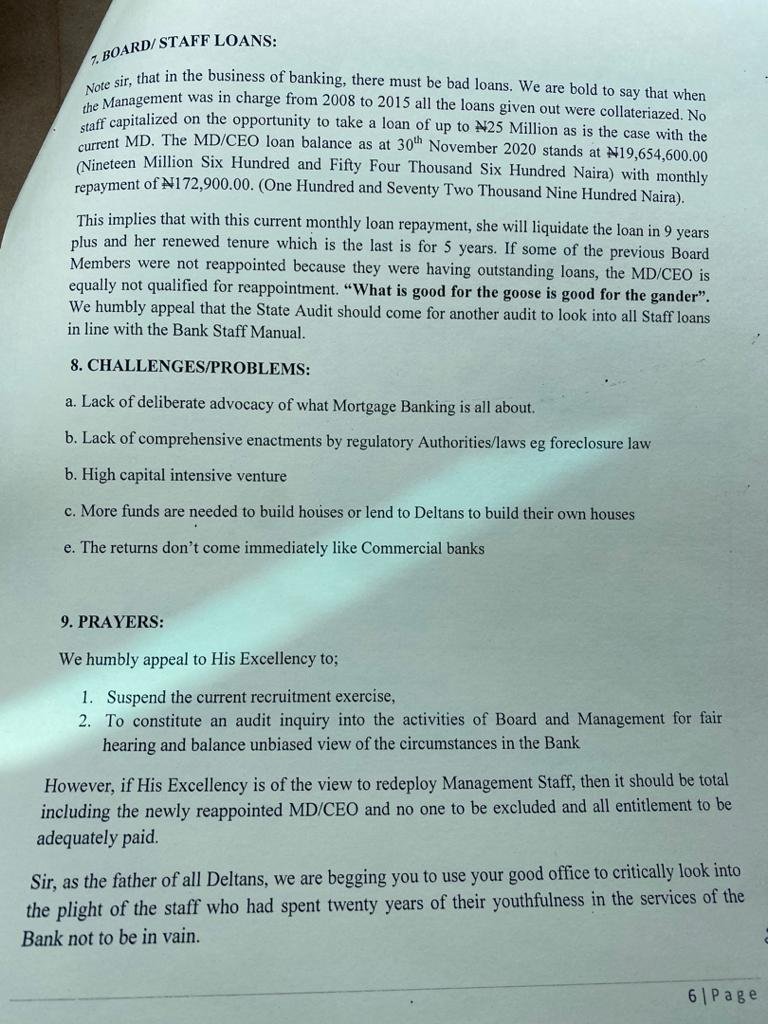

They stated that every reason for disqualifying some of the previous Board members also touched the MD/CEO as she was barely two years into her first tenure when she collected a loan of N25 million contrary to the Bank’s Human Capital Manual.

“It is on record that due process was not followed. The loan is currently running for 12 years, while her first tenure was five years. As at the end of her first tenure in June 2020, she was still indebted to the bank to the tune of N20, 346, 200. All staff loan are tied to expected retirement period.

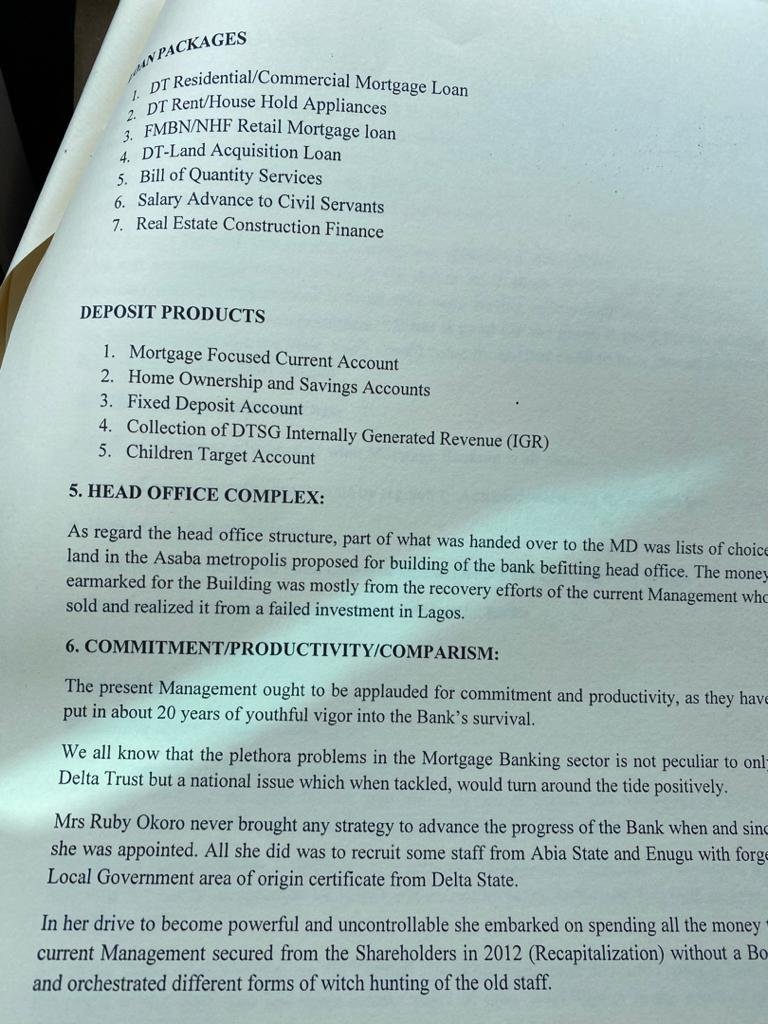

“From the records, we discovered that her only experience in Commercial bank was a senior manager in a branch in Warri, before she proceeded to Canada for greener pasture. She never had a management/managerial experience hence when she was engaged she had no blue print in moving the Bank to the next level. All achievements attributed to her were due to the unalloyed support and structures put in place by the present Management before she was engaged”.

They accused the MD/CEO of usurpation as the current organogram gives her too much powers to do all approvals as all Heads of Department reports to her directly except very few HODs who ought to report through the Executive Director but in practice still reports to her directly.

“Even when she is not in the office as in when she travelled out of town she insisted that all approvals for expenses must be done through text messages and or through emails thus making her the sole final and only approving entity. Even when she is on leave, she approves via mails and more often she never hands over to the ED.

“The recommended new management Organogram of six members in which the MD/CEO as the only Executive Director to be in the Board and other proposed new staff to be employed single handedly by the MD/CEO as advertised in the newspaper to submit the respective application to the office of the MD/CEO is tantamount to tyranny, an abuse of administrative/corporate practice and against the approved Organogram by CBN”, they lamented.

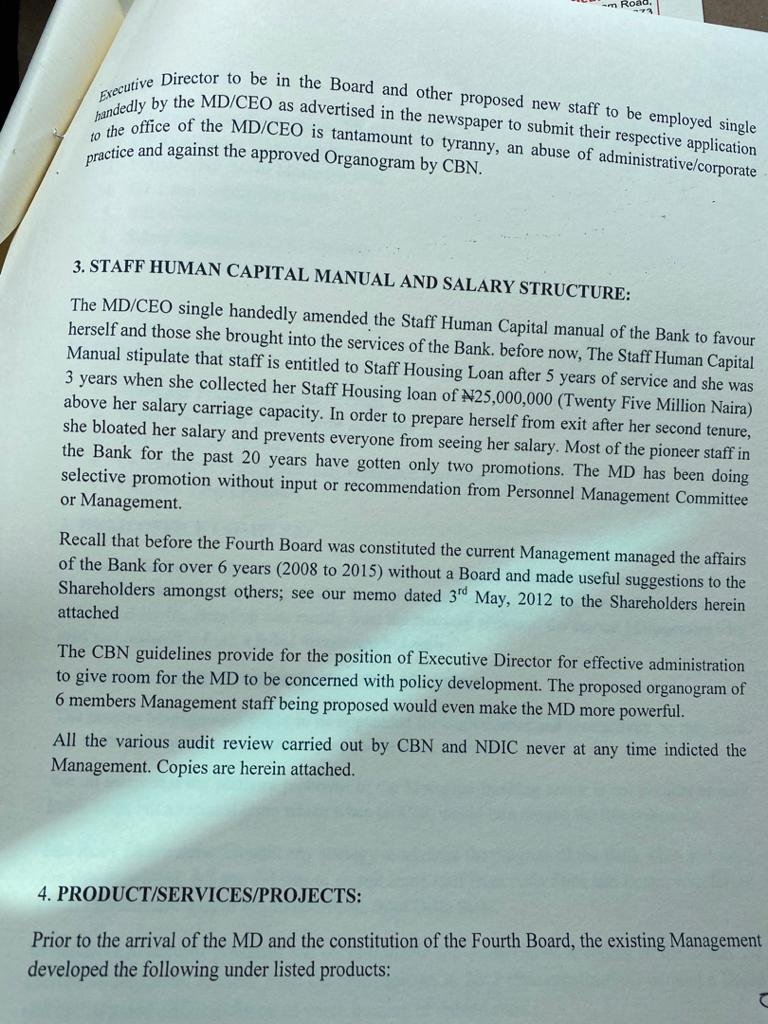

They alleged that the MD/CEO single handedly amended the staff Human Capital Manual of the bank to favour herself and those she brought into the services of the Bank just as they revealed that the staff capital manual stipulates that staff is entitled to Staff Housing Loan after five years of service and she was three years when she collected her staff housing loan of N25 million above her salary carriage capacity.

“In order to prepare herself from exit after her second tenure, she bloated her salary and prevents everyone from seeing her salary. Most of the pioneer staff in the bank for the past 20 years have gotten only two promotions. The MD has been doing selective promotion without the input or recommendation from Personnel Management Committee or Management”, they further alleged.

They prayed that the governor should suspend the current recruitment exercise, constitute an audit inquiry into the activities of the Board and Management for fair hearing and balance unbiased view of the circumstances in the Bank.

“However, if His Excellency is of the view to redeploy Management Staff, then it should be total including the newly reappointed MD/CEO and no one to be excluded and all entitlement to be adequately paid”, the petitioners stated.

Text message sent to the MD/CEO for her reaction on allegations levelled against her was not replied.

Contacted, the Finance Commissioner, Sir. Tilije, said: “We are trying to restructure the bank and what we have done is to advertise positions in the Newspapers and we have asked those who are management staff now to also apply so that based on that structure, those people who are very good and who are also not at the level they are supposed to be would then be upgrade.

“If you are at a level and you are not functioning well, we either will downgrade you, which is normal or move you out of the bank entirely to the civil service. So, we are restructuring, the Bank has been there for so many years and the Delta state government has been spending series and very serious amount of money.

“We have done so much in recapitalization and it is not yielding any profit. There is no way a mortgage bank owned by Delta State should not be making profit but rather we are using government money to fund them. So, of what use is it?

“It is a commercial outfit so it should be treated as a commercial outfit. That is what we are doing, they are not civil servants, they are not supposed to be. Banks generally in the whole world are making profit whether they are mortgage, savings or they are commercial, they make profit.

“So, we cannot sit down and be sinking government money into the mortgage bank on an annual or twice yearly basis and don’t get returns from it, it doesn’t make sense, it just does not. So, what we are trying to do is to restructure. We have not sent the management team packing, we haven’t done that but we are going to reinterview all of them and see whether they are people who are visionary or people who don’t want to do anything. Because the way it is now, people are thinking it is a civil service organization, government will always bring money to pay our salaries, gone at those days, I will take that personally.

On the petition to the governor by the Executive Director of the Bank, Tilije said: “As an Executive Director of the bank, is he supposed to use the letter head paper of bank to write a petition?

“How can an Executive Director of a bank use the letter head paper of the bank to write a petition against the bank. Does it makes sense to you? We say people who are older are very backward they have not been able to help this country but the younger ones are extremely to be showing worst positions.

“You work in the bank as an Executive Director, you are using the letter head paper of the bank to write a petition against the bank. Isn’t that a dismissal act?

“Is he saying that he has more responsibility than the MD of the bank? So he gave him that portfolio that it must be him that will sign off for an advert in the newspaper?

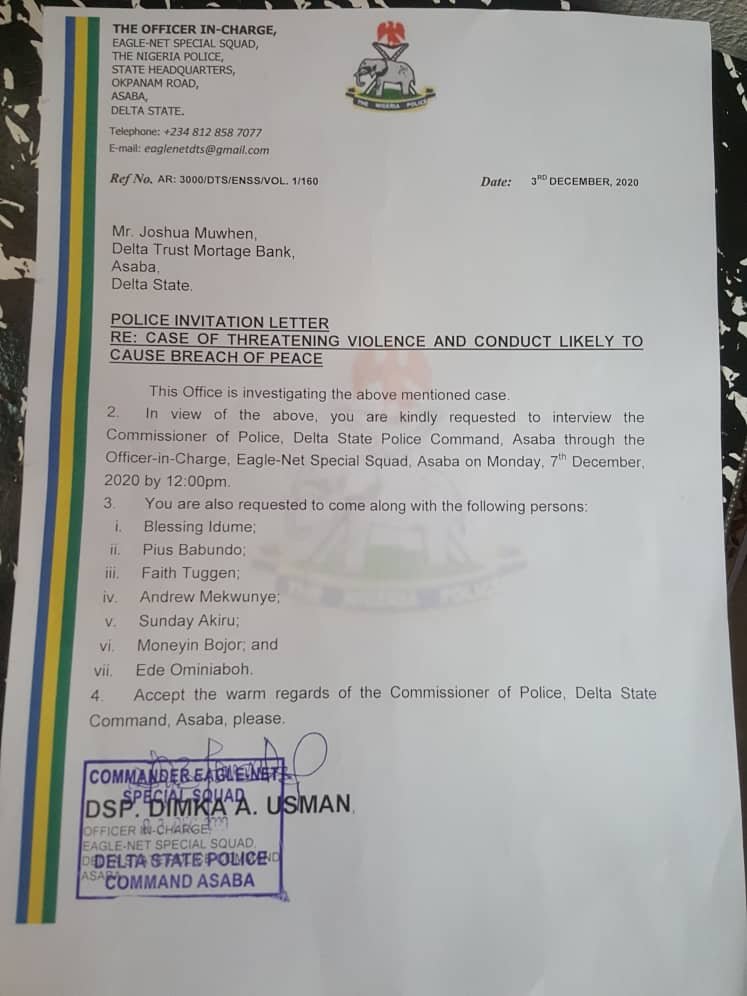

In another development, the MD/CEO, went to the police to incident report of threatening violence and conduct likely to cause breach of peace against the Executive Director and seven others.

In a letter dated 3rd December 2020, from the officer in-charge, Eagle-Net Squad, the Nigeria Police, State Headquarters, Delta State Police Command invited the Executive Director of Delta Trust Mortgage Bank Limited, Mr. Joshua Muwhen, to the police.

The letter reads in part: “this office is investigating the above mentioned case. In view of the above, you are kindly requested to interview the Commissioner of police, Delta State Police Command Asaba through the Officer-in-charge, Eagle-Net Special Squad Asaba on Monday 7th December 2020 by 12:00pm”.

It was gathered that while the Management Staff were at the police to answer to why they were invited, an interview was allegedly conducted on Monday 7th December 2020, for those who applied for vacant positions in the Mortgage Bank.

Our source disclosed that their invitation was allegedly aimed at keeping them at arm’s length to prevent them from taking part in the interview and recruitment process in order to perfect the alleged plot to lay them off.

Similarly, another letter from the office of the Finance Commissioner, dated 7th December 2020, signed by Umukoro Daniel, for the Finance Commissioner, invited the eight persons for a meeting with the Finance Commissioner on Tuesday 8th December 2020, at the conference Hall of Olorogun Felix Ibru Secretariat.

At the time of filing this report, it could not be ascertained whether they were still being held by the police.